Module 8: The Ask

Learning objectives: what to ask investors for, how to work out when you will be in a position to raise again, and how to validate your ask.

The objective of fundraising is not to get cash into your business now. It is to get enough cash to achieve enough success to enable you to raise again, or become self-sustaining. This module will help you understand how to think about your ask, what you can and can't ask for, and work out when you will be in a position to raise your second round. You can use this milestone to calculate your ask for this round with some precision, using the ASK GENERATOR in the FINANCIAL MODELLER. You will also find how to validate your ask, to see if it is in a ballpark that investors will recognise, and whether the balance of funding and equity dilution is right for you.

Back to course overview

Written and audio guide: 17 mins

Summary video

Essentials

How to approach it

Slide template

Investor insights, covering common mistakes and tips and tricks

More resources

2 Tool exercises:

Understand when you will be in a position to raise again, to clarify what success you are selling in this round and calculate your ask better (~45 mins)

Validate your ASK using several common valuation methods (~15 mins)

U2R Milestone Maker

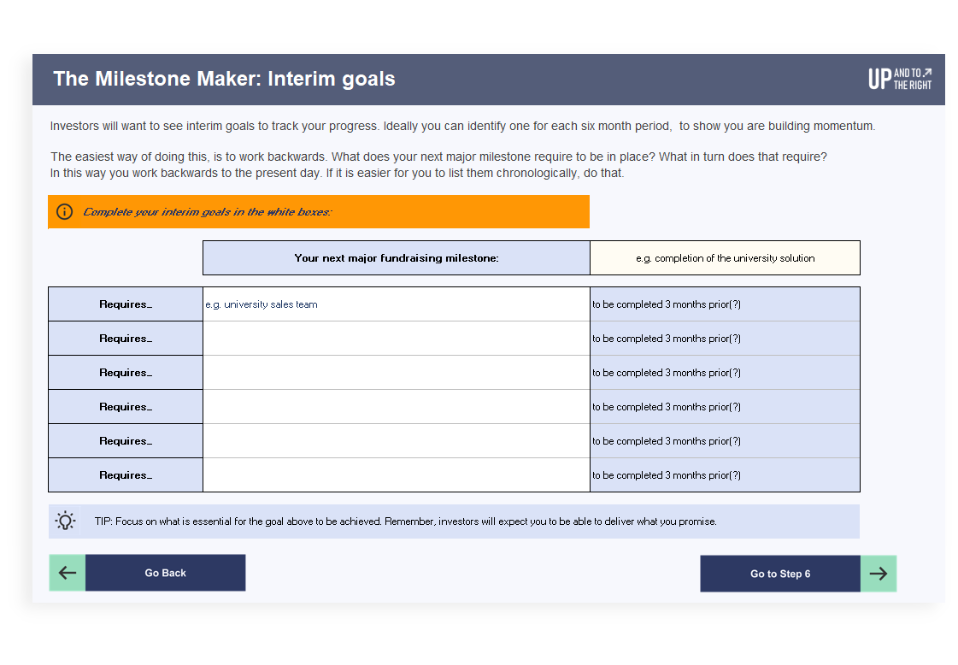

The most successful fundraisers raise enough to reach their second round of fundraising. This is usually triggered by reaching a significant business or financial milestone. The U2R Milestone Maker helps you understand what this might be, both so you know when you may be in a position to raise again (so you ask for enough this time), and you are focused on what you are going to achieve. This is the success you are selling to investors. The tool also helps link your ask to specific interim goals.

U2R Ask Validator

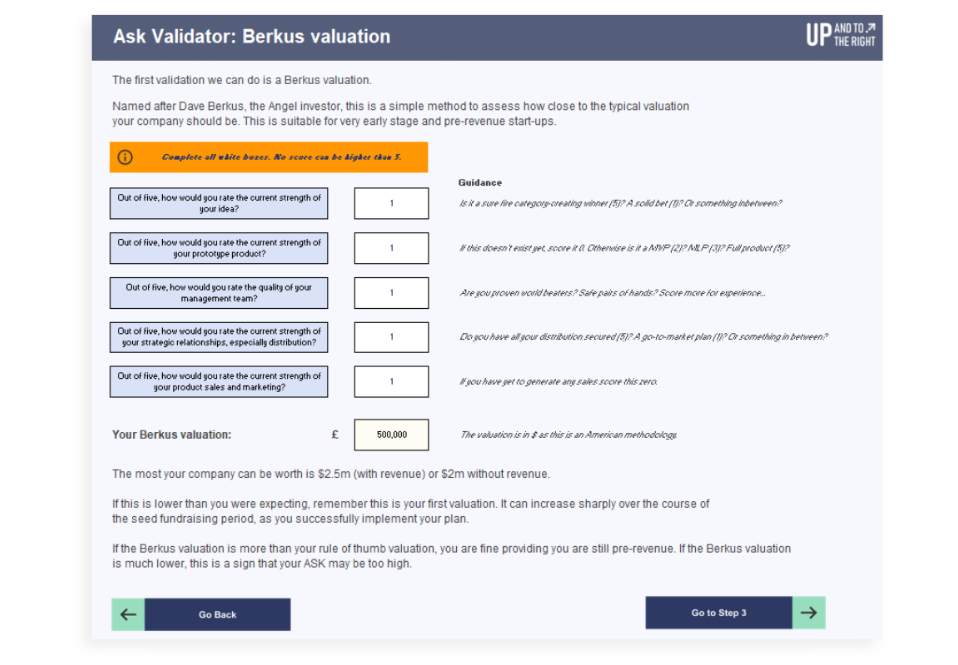

You're asking investors for fundraising, but how do you know if your request is in a ballpark they will recognise? They don't assume your business is already worth $1m, even if you are convinced it is. The U2R Ask Validator uses several types of common valuation methods used by investors, to give you an idea of what your start-up is worth. You can use this to optimise the balance between the amount you ask for and the amount of equity you have to surrender.

The Start-Up Pitch Deck Course

£399 / $499 / €449

Lifetime access to all content and community

BUY NOWMaster fundraising fundamentals

Get instant access to everything you need to perfect your pitch deck and boost your fundraising chances. If you need us, we're here to review, solve any problems and hear your practice pitch.

'Working with Marcus and Nick has been a magical experience. They've helped me crack my own pitch deck and messaging. They've done the same for startups we invested in. They can do it for you as well.'

Peet Denny, Founding Partner - Climate VC

As an angel investor you have the ability to influence and make a real difference with the value you can add. Marcus does this through his startup investments and Nick has added so much value along my journey including through the Thunderdome where I perfected my pitch deck and purpose statement. Big thank you to the U2R team!'

Andy Ayim, MBE and founder of Angel Investing School

'The team at U2R are the real deal. They have been there and done it. For me that is the type of person I trust to give advice/ guidance, not self appointed experts.'

Scott Wylie, serial founder and CEO of Seven